placer county tax deed sales

Parcels removedsales voided after sale. Free Placer County Recorder Of Deeds Property Records Search.

1999 Placer County Government State Of California

Notice of Impending Power to Sell Tax-Defaulted.

. Placer County currently uses Public Surplus and GovDeals online auction sites for disposal of surplus property. Placer County relies on the revenue. Find different option for paying your property taxes.

Parcels sold at sale. What is the sales tax rate in Placer County. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties.

Placer County CA currently has 465 tax liens available as of September 24. The auction is conducted by the county tax collector and the property is sold to the highest bidder. Public Auction Reoffer 2016 Sales Results.

The minimum combined 2022 sales tax rate for Placer County California is. The Treasurer-Tax Collector is not allowed by law to sell properties by any means other than at a public auction. Offering these materials in an online format is a greater convenience to the.

The 775 sales tax rate in Rocklin consists of 6 California state sales tax 025 Placer County sales tax 05 Rocklin tax and 1 Special taxThe sales tax. Public auctions are the most common way of selling tax-defaulted property. Public property records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

The records office at your local courthouse and county office building can give you access to public records at no charge. Placer County does not sell tax lien certificates for tax-defaulted properties. Placer County sells tax deed properties at the Placer County tax sale auction which is held annually during the month of October each year.

Consolidated Placer County California tax sale information to make your research quick easy and convenient. Estimate your supplemental tax with Placer County. They are maintained by.

If you believe the. Notice of Property Tax Delinquency and Impending Default 2020. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

SYREK THELMA FARKAS MARGARET. Find Placer County residential property records including deed records titles mortgages sales transfers. Placer County Tax Collector 2976 Richardson Drive.

Do liens or encumbrances on a tax-defaulted property transfer to the new owner after purchase of the property at a tax sale. Parcels receiving no bids. Appeal your property tax bill penalty.

This is the total of state and county sales tax rates. Nationwide tax sale data to power your investing. Go to the courthouse and county offices in person.

Public property records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Parcels redeemed or removed prior to sale. Parcels offered at sale.

If you have questions about the recorded document or letter please contact the Placer County Recorders Office at 530 886-5600 or email clerkplacercagov.

Tax Deed Information For Understanding And Acting On Tax Deed Sales

Document Other February 28 2020 Trellis

Job Posting Public Administrator Assistant Placer County

Treasurer Tax Collector Placer County Ca

Job Posting Appraiser Senior Placer County

Sold Price Placer County Fruit Crate Labels 118251 June 4 0120 8 00 Am Pdt

Complete List Of Tax Deed States

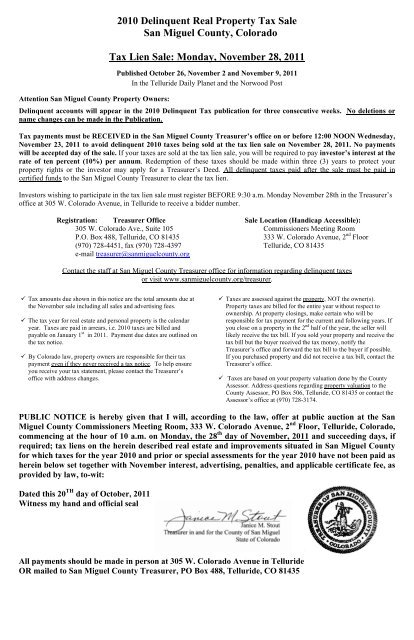

Colorado County Treasurers And Public Trustees Associations

2011 Tax Lien Sale Pub San Miguel County

Complete List Of Tax Deed States

Mountain Democrat Friday September 9 2022 By Mcnaughtonmedia Issuu

Complete List Of Tax Deed States

Buying Properties Before Tax Deed Sale Youtube

News North Tahoe Business Association